YC – or Y Combinator – is a prestigious startup accelerator in Silicon Valley. Boasting an acceptance rate lower than those of Harvard and Stanford, YC matriculates “startups” that are ready for hypergrowth. In our observation YC chooses going-entity “startups” and banmboozles founders into a depressed valuation to get their shares at a below-market price before institutional capital steps in.

That said, YC graduates two classes per year: one in summer and one in winter. Below are YC’s latest summer graduates that focus on brick and mortar, and our analysis of their prospective performance.

Cuboh

The first company on our list is Cuboh. Cuboh seeks to seamlessly integrate online ordering into restaurant POS systems, eliminating the tablet hell many restauranteurs face. Given the amount of funding companies like Ordermark have raised to do virtually the same thing (albeit with hardware in Ordermark’s case), it’s no wonder YC took a closer look. Here’s the math that got YC excited:

Cuboh seeks to seamlessly integrate online ordering into restaurant POS systems, eliminating the tablet hell many restauranteurs face. Given the amount of funding companies like Ordermark have raised to do virtually the same thing (albeit with hardware in Ordermark’s case), it’s no wonder YC took a closer look. Here’s the math that got YC excited:

- US restaurants do $800B in sales

- Over the next 10 years 25% of those orders will come from digital channels (i.e. TAM = $200B)

- Cuboh and others just need to capture a small percent and they will be doing billions in revenue!

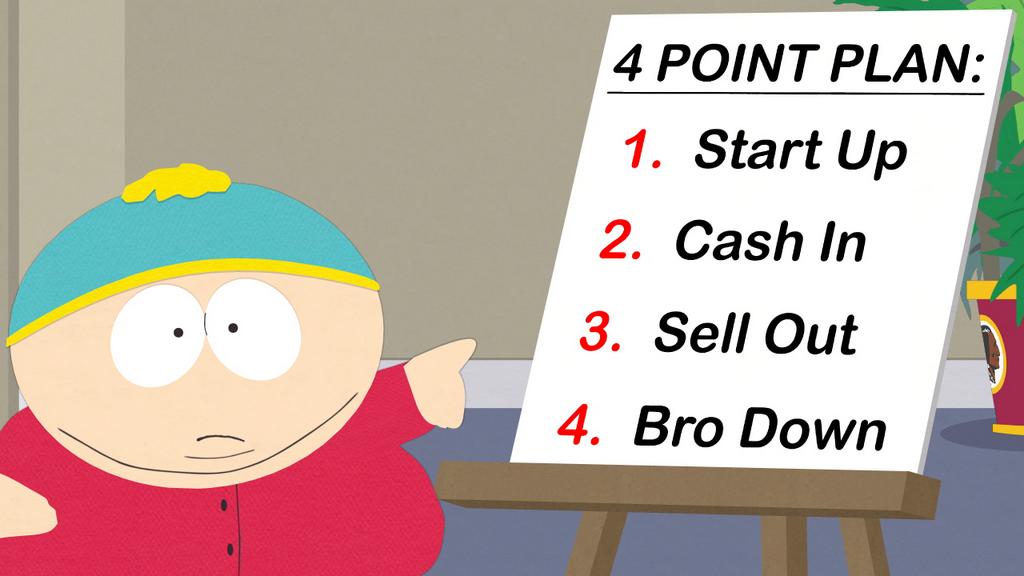

South Park explained this math better than us, candidly.

Yet we don’t see a bright future in the long term for aggregators.

First, we think POS companies will build and support APIs for online ordering integrations. Shift4 has done this, as has Revention. Same with Focus, RPower, and several others (though it’s not yet public). We’ve already stated that POS companies need to build an aggregate interface for online ordering as well, and this will be the encore after POS companies get their APIs in order.

Second, we think that many of the “integrations” marketed by these aggregators are hacked and therefore unapproved. That’s maybe not a bad thing for the market, since POS/payments companies are really hard to work with and the large online ordering/delivery companies are trying to multiply their revenues and don’t have the time to slow down and think about integrations (even if it’s in the best interest of their customers). But still, it’s a problem if one of the integrated systems changes something and it breaks what the aggregator does. So this has to be remedied.

The bet on these aggregators is mostly a bet on payments companies screwing up innovation and the cadence of R&D at the POS companies they acquired. So maybe it’s not a bad bet.

Flux

The next company is Flux, a Latin American startup that processes mobile payments around the card networks and requires no POS integrations. Flux provides merchants with a camera dongle that they attach to their terminals. A consumer then logs into their bank app on their mobile phone and scans the QR code generated on the card terminal. From here the money moves between the customer’s account and the merchant’s account.

This is a great stab at disrupting interchange, yet we see a few problems.

First is the hardware piece. Hardware is hard. Assuming they successfully navigate the hardware business (manufacturing, logistics, tariffs, etc.) merchants won’t be smart enough to install the hardware and you’d need to financially incentivize someone in the channel to do the installation. We’ve seen POS companies offer $300 spiffs to their dealers to complete one-hour tasks and the adoption rate has been less than 1% (apparently dealers make more than $600,000 in personal income… who knew). So this will be challenging.

Second is mobile app adoption. It would be better if Flux could use an API layer like Plaid and tie it to a widely used app like WeChat, Facebook or analogous. We don’t know how many consumers will download a bank app for payments, and it’s why the most widely-used apps are aggregators (Yelp, UberEats, et al.).

Third, and the biggest risk, is that the incumbent providers are adversely impacted from Flux’s success. If Flux is eliminating the card network, how much longer before they can stand up a bank account for the merchant and do the acquiring? Or for the consumer? We wish them luck and hope to God they succeed, but there’s a whole world of sleazy payments entities that don’t want a positive outcome.

QR payments aren’t novel, but maybe they will figure out distribution and disrupt interchange.

LineLeap

LineLeap is the third company, and it’s basically OpenTable for bars. We counted 47 live locations (via their website) and saw a reported revenue run rate of $30,000 per month. This would mean each location is paying roughly $640 per month, or what your average OpenTable customer also pays.

LineLeap has the classic chicken-and-egg problem where they need to enroll customers to get merchants onboard and vice versa. OpenTable started by hocking physical hardware (reservation systems) to white tablecloth restaurants. Once they had enough restaurants on their systems they flipped the switch and started a website. LineLeap might do well to learn from that strategy as it’s infinitely easier to focus on selling a single product to a customer group

What OpenTable didn’t do in its early years – and Jeff Jordan shared was a massive oversight – was integrate to the POS. This left OpenTable out of many of the R&D opportunities POS affords someone. It’s now why OpenTable asks users for permission to collect their ordering data from the POS of the restaurant they’re patroning.

Marble Technologies

Fourth up is Marble Technologies, which offers a cashier-free checkout experience (i.e. a self-ordering kiosk). Many large restaurant brands have started implementing kiosks already, whether it’s QSR and fast casual groups building their own technology (in an overpriced manner, we might add) or table service restaurants punting to a partner like Ziosk or Presto for table-side ordering.

Marble undoubtedly sees the legislative pressures on retail in the form of minimum wage hikes or predictive scheduling (which is literally one of the dumbest things we’ve seen in a very, very long time) and recognizes the opportunity to automate the front of house experience. They’re also noticing that a kiosk can upsell better than hour $8/hour employee, showing basket size growth of 16%. (For the record, across all of our restaurant data we see kiosks creating checks that are 22% larger than those coming from an employee.)

The difficulty here is going to be distribution. How can Marble effectively get retailers to buy into this technology, and how do they get it installed? And $12,000 per year per store seems pricey.

Mipos

Mipos is a “restaurant operating system” but seems to be an online ordering management tool. What’s most impressive is that 20% of restaurant sales in Latin America already come from online ordering providers.

We expect Mipos to have the same challenges at Cuboh, and don’t need to relitigate those here.

Simmer

Lastly we have Simmer, which sounds an awful lot like Kevin Rose’s failed Oink, where you could rate individual dishes at restaurants. Simmer’s differentiator seems to be that they objectively look at reviews of dishes from online ordering and delivery sites then direct you to make the purchase. Unlike other companies on this list Simmer doesn’t need to deal with the hassle of physical merchant distribution and can use SEO and scrape data to develop their product, which is nice, but not defensible.

Online ordering and delivery is growing, and the market is pretty commoditized – this is good for Simmer. Yet Simmer strikes us as a newer version of Yipit, a company that aggregated daily deals and just referred customers to the daily deal provider for an affiliate fee. If the online ordering companies own the restaurant’s customer relationships, will Simmer own the online ordering company’s customer relationships?

It makes our heads hurt.

So we think Simmer is nothing more than a quick acquisition play for one of the ordering or delivery companies. We don’t see anything with more utility yet, but who knows what they’re working on under the hood.

———

None of these YC companies is doing anything that innovative, but Flux is at least trying to do something big. QR tech is old hat, but if they can scale that the right way they have a shot at really disrupting payments industries. Go Flux.

Add comment